Use the 20/3/8 Rule When Purchasing a Car

For most of us owning a reliable car is a necessity. We need it to get to work, buy groceries and most of us aren't willing or able to ride our bike in a blizzard and public transportation can be unreliable and even unavailable. We do have 2 cars that are 11+ years old, but are low mileage (for their age).

We have had discussions recently regarding the potential need to replace one soon purely based on one being a compact car. Great for parking in the city for date night, horrible to doing basically anything with 2 young kids in tote. So we went to town on researching how to evaluate the best car for us and the best method to pay for it.

But how much is too much car? What is the best financial plan when making a car purchase? Is there a finical rule for purchasing a car? The general consensus of the debt free community is:

Do Not Finance a Vehicle if at all Possible

It is a depreciating asset and very easy to end up underwater on a loan. If you're able to, pay cash. Even if it means you can't buy the latest and greatest model.

However, for many of us, we don't have $10K, $15K or $20K readily at hand to plunk down on a car and we need to finance. I found the 20/3/8 Rule from the @moneyguyshow and I think it's a great way to set yourself parameters so you don't end up overextending yourself thanks to a pretty floor model and a flashy salesman.

Put down at least 20% - the more equity you have upfront the better.

Payoff the car 3 years - you pay less interest and will own faster than a 5 year loan.

The monthly loan payment shouldn't be more than 8% of your gross monthly income.

For example, if you make $50K a year ($4,167 per month), your monthly loan payment shouldn't be more than $333.

Just for a quick reference, take a look at the table below to get a general idea of where your car payments should fall using the 20/3/8 rule.

Test drive your car payment before you have a car payment

Now we have an idea of what we can afford. How about we try putting the amount of the expected monthly car payments into a savings account, ideally a sinking fund (that lives in a High Yield Savings Account) that is already setup, every month and see how it effects your life. Do not touch that money. Just live as if there is already a car payment.

If you are okay with it after 6 months or so, then go ahead and buy the car that is within that budget. You will not only know that you can comfortably afford that vehicle, but you will also have money that has been saved that gained value via interest to contribute towards the down payment.

If you start planning and saving early, you may be able to just drive free for life

Dave Ramsey has great method he calls “Drive Free, Retire Rich” that I really like (with some stipulations).

If you are able to do some planning and have a longer time horizon on buying your a car, maybe take things to the next level and invest those monthly payments. Throw them in a Brokerage Account or Mutual Fund and invest in Index Funds. See the investment potential below if we were to save $500 per month for just 3 years with a fairly conservative return of 10%. Investment growth will ideally protect those contributions from inflation and allow you to buy nearly $3,000 more car if you so choose!

Calculated using https://www.calculator.net/investment-calculator.html

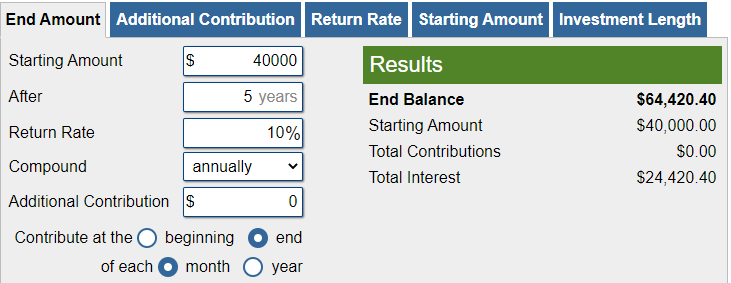

Depending on what type of car you intend on buying, as well as how long you can hold out on buying that car, you can cycle this method and “drive free for life.” Using the same method, lets say you were able to hold off on taking out funds and grow that investment to $40K. I know, ideal scenario, and that is many years of saving…but if you can get there the potential is massive. Let’s say you stopped contributing to that investment once it hit $40K. Every 5 years, assuming a 10% return you could take out $24K to upgrade your car. Leave that initial $40K in the account to replenish, and rinse and repeat.

Calculated using https://www.calculator.net/investment-calculator.html

Time to burst the bubble on “Free Cars For Life” as an investment strategy.

Now to play devils advocate…I said there were stipulations with this method that need to be taken into account. Every theory sounds great until they are hit with reality. Here are some of the realities of this investment strategy.

First off, we have to keep in mind that there will be capital gains tax (15%) on any withdrawal

Second, we have seen double digit investment return in the stock market for many years, but there is no guarantee that it will stay the same. Many researches even say that single digit investment growth is likely in the future.

Third, this method is tied solely to the stock market. The timing of your withdrawal may not align with the amount that you projected to pull out. If there are major market dips your investment could very well be worth less that what you started with…

“No Free Car for You” (in my best Soup guy from Seinfeld voice)

In Summary:

As with any investment, a little bit of research and prep will go a long way. A car is a necessity depending on where you live, so we should try our best to make sure that we fit the cost into our lives and not the other way around. There is no one best method to buy a car and make it fit your lifestyle, we just like the 20/3/8 method. We personally see our vehicles as means of transportation, this can be very different depending on your job or lifestyle. What do we think about these methods? I would love to hear other methods similar to Dave Ramsey’s “Drive Free” method.